A corporation’s day-to-day operations are managed by the board of directors through their designees, the officers of the company. While the officers perform a significant amount of the day-to-day work, the directors provide advice concerning big-picture decisions. Certain decisions – certain really big-picture decisions – requires shareholder votes. To have that vote in a closely-held corporation is not an arduous task – to get an agreement may be more arduous depending on your other shareholders. A publicly-traded corporation is a horse of a different color altogether. To obtain the votes of the shareholders, a publicly-traded corporation must either hold a formal meeting where a quorum of shareholders attends. A quorum is the minimum number of members of an assembly or society that must be present at any of its meetings to make the proceedings of that meeting valid. To obtain that quorum, either the shareholders must be attendance physically, or virtually in our brave, new world, or through a proxy.

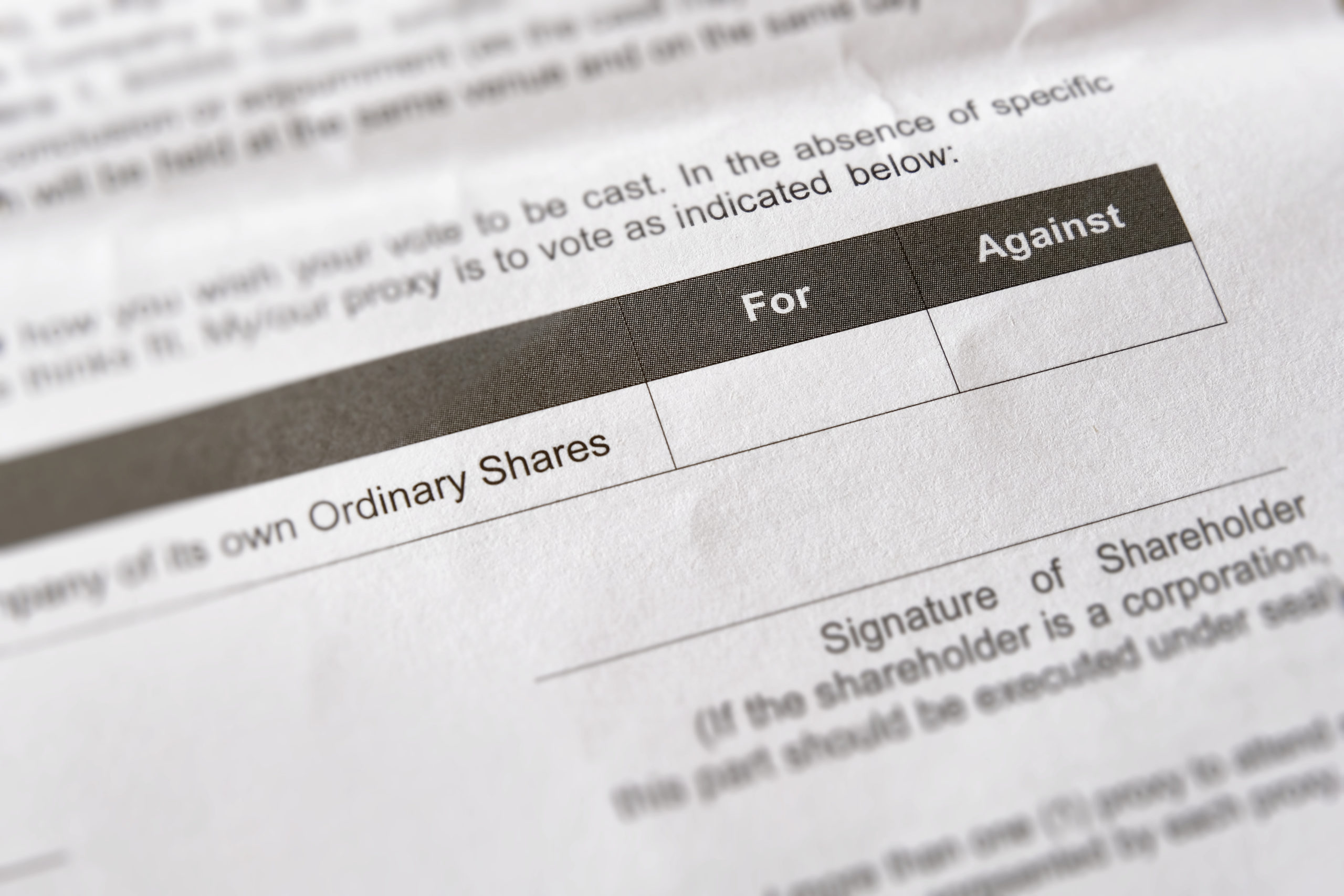

A proxy is the authority to represent someone else, especially in voting. For a publicly-traded company, a proxy is the written permission for the proxy holder to represent a shareholder’s interest at the shareholder meeting. A proxy can be specific or broad and can be revoked through a writing, or through attendance at the meeting.

A publicly-traded corporation may gather the proxies of its shareholders through a specific, detailed method through the Securities and Exchange Commission Rules.

What is Form PRE 14A?

Also known as a preliminary proxy, Securities and Exchange Commission Form PRE 14A is a filing submitted on behalf of a registrant when a shareholder vote is required for items unrelated to a contested matter or merger or acquisition.

Under Section 14(a) of the Securities and Exchange Act of 1934, Form PRE 14A is mandatory for all corporations that require shareholder votes. The Form PRE 14A is filed prior to the proxy in its final form, the Form DEF 14A. The proxy discloses all relevant details in connection with the issues that must be decided upon by a company’s shareholders.

Form PRE 14A must be filed in connection with the announcement of annual meetings, stock issuance, the election of directors, altering a company’s articles of incorporation, shareholder proposals, and compensation for board members. If there is just one issue to be voted upon — such as a shareholder proposal — the SEC does not require the form to be filed.

Form PRE 14A includes information regarding the following:

- The date, time, and location of the shareholders’ meeting

- The revocability of the proxy

- The person making the solicitation

- The rights of dissenting shareholders to an appraisal

- Financial statements

- Voting procedures

- Modification of securities

Proxies are very complex, and there are numerous rules involved. If the form is not prepared correctly to ensure compliance with the SEC, a company can risk running afoul of federal securities laws. The preliminary proxy statement must be filed with the SEC through the EDGAR system no fewer than ten calendar days before filing a definitive proxy statement is filed and sending the materials to the shareholders. If the SEC requests clarification or a correction, the filer will receive a notice within those ten days.

What is Proxy Voting?

Before each annual meeting, shareholders may receive a proxy statement that describes the issues up for a vote. By using a proxy, a shareholder can delegate the right to vote on certain issues to a representative. This delegation is done because the shareholder is unable to attend the meeting or the representative is more informed on the specific issue requiring a vote. This individual will vote in accordance with the shareholder’s wishes that have been written on a proxy card.

Notably, SEC rules allow shareholders who own at least $2,000 of company stock to submit shareholder proposals concerning corporate, environmental, governance, and social issues as long as they have held their shares for three years prior to the yearly filing deadline. They are permitted 500 words to frame their case. Management may respond by filing an opposition. Any matters related to personal grievances, operations constituting less than 5% of revenue, and issues in connection with ordinary business may not be addressed with a proposal.

Contact an Experienced New York Business Attorney to Learn More

If you’ve never voted by proxy before, it’s essential to understand the SEC’s rules and requirements. Brinen & Associates is dedicated to helping clients with a wide variety of corporate and securities matters and assisting them with ensuring SEC compliance. Call (212) 330-8151 or send us a message to learn more.