“And that man comes on the radio, And he’s tellin’ me more and more, About some useless information, Supposed to fire my imagination” – M. Jagger & K. Richards

Dial the help number for the Internal Revenue Service.

Dial the help number for the Internal Revenue Service.

Press a few buttons to get to the right department.

Enjoy MUZAK’d classical music for the next eighty-seven minutes.

Be told by an agent that they can’t help without Document X.

Rinse. Repeat.

While most Americans believe that it is unacceptable to cheat on your taxes, there is a growing unrest with the Internal Revenue Service. The customer service is terrible. Forget the customer service you get at your bank or at a drive through window. The IRS has whipped out a shovel, and started digging.

The customer satisfaction has dropped to its lowest level since they started tracking “customer satisfaction” for the IRS.

Given the sad state of the politics in this country, this number will drop. If the extender bill is passed, the government is actually going to cut funding to the Service instead. Or if the government closes, then the whole department shuts down EXCEPT automated collections.

How much fun is it going to be to try to handle a notice with no one picking up the telephone on the other end of the line?

We recommend getting in front of any tax problem with either an Offer in Compromise or payment plan.

But as we’ve written before, we also don’t recommend tackling these issues without competent representation.

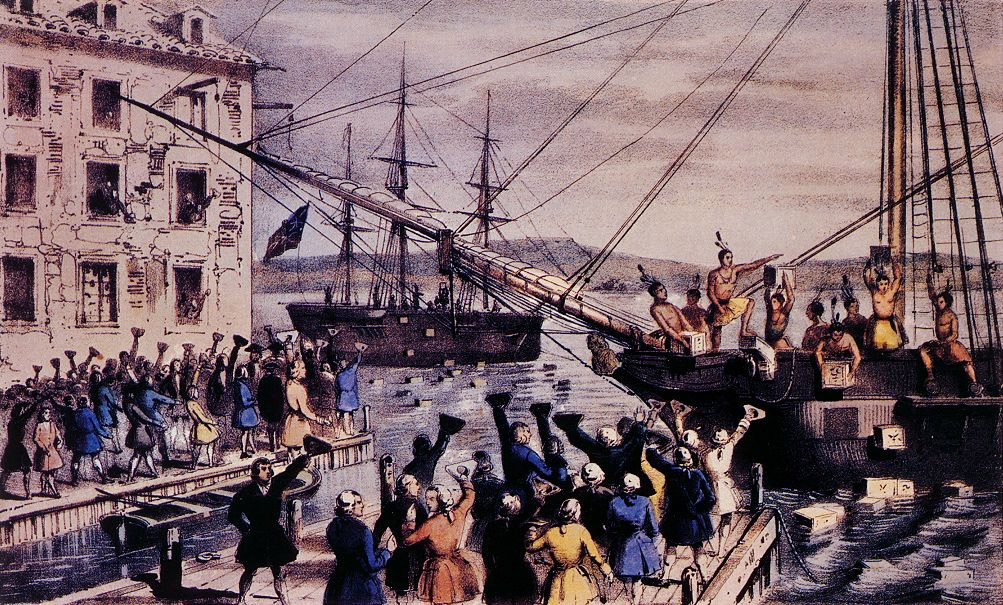

In any case, our country seems to have taken a curious turn in recent years. Having been founded on the notion of no taxation without adequate representation we seem to be keen on retesting the validity of our own origin stories and founding myths. By making the taxing authority almost completely non-responsive we have simply created an additional burden on our citizens to obtain adequate representation in the form of competent counsel. Far be it from me to divine original intent, but I seriously doubt this is what the Founding Father’s had in mind.